Wealth management experts at FAS provide some insightful tips on saving for your children’s future

Parents and grandparents are often seeking advice on how to invest for their child or grandchild’s future, with the aim of contributing towards higher education costs, or a deposit for their first home. With the pressures of modern living, many young people will struggle to save for a deposit, amidst costs of rent, bills and living expenses. It is, therefore, often the case that children turn to the ‘Bank of Mum and Dad’ for help, which could well coincide with a time when parents themselves are under financial pressure, either paying down outstanding mortgage debt or trying to focus on retirement planning. Arranging appropriate investments for children can ease the financial burden for families and help provide the necessary funds when required.

Two of the most popular methods of arranging children’s investments automatically belong to the child on their 18th birthday. A Junior Individual Savings Account (JISA) allows a maximum investment of £9,000 per annum, and this can be funded by parents or other relatives. As an ISA account, all growth and income earned from investments held within the JISA are tax-exempt.

Another tax efficient way to save for a child’s future is by using a bare trust. The funds in trust belong to the child but are managed by the trustees (usually parents and grandparents) until they reach the age of 18. All income and gains generated within the trust are assessed on the child, except when the trust is created by a parent. In this case, income that exceeds £100 per tax year is assessed on the parent. It is important to note that this rule does not apply to grandparents.

A common

conversation point are the risks involved when giving control of an investment to a child at the age of 18. Many parents and grandparents have concerns that the child may not make financially responsible decisions at this point in their life. The alternative is to exert control over when the child gains access to the funds. This is often a more palatable option; however, there are drawbacks that need to be considered.

Instead of a bare trust structure, where the child owns the investment from the age of 18, a discretionary trust offers far greater flexibility and control. The trustees have complete discretion as to when funds are paid, and to which beneficiary. Discretionary trusts do, however, suffer a more punitive tax regime, which starts with the gift into trust and covers both income tax and capital gains tax. Discretionary trusts also suffer a potential charge to inheritance tax at each ten-year anniversary.

Irrespective of the approach taken, the effectiveness of long-term savings will largely be determined by the strategy adopted and the performance of the chosen investments. Trustees are duty bound to take advice when choosing trust investments, which should also be regularly reviewed to ensure they remain appropriate. An independent advice firm can provide unbiased advice to parents and grandparents on the available options.

Learn more about FAS at financial-advice.co.uk

The content of this article is for information only and does not constitute financial advice. It is for general information only and should not be relied upon when making any financial planning decisions. You should always obtain professional independent advice based on your circumstances. Tax legislation is subject to change. Financial Advice & Services Limited, Independent Financial Advisers, authorised and regulated by the Financial Conduct Authority.

FAS copyright 2025.

You may also like

Newsboard

Two schools tell us about their latest goings on and invite you to visit… Free to be Me at Bansted Prep At Banstead Prep our focus is on joyful, future-ready learning where every child is Free to be Me –...

What’s Next?

Sixth form is a crucial stage with decisions to be made.We hear from two schools about how they prepare students for their onward journey School 1: Bede’s At Bede’s, while we focus on a joyful school experience, we also recognise...

Awesome Stuff

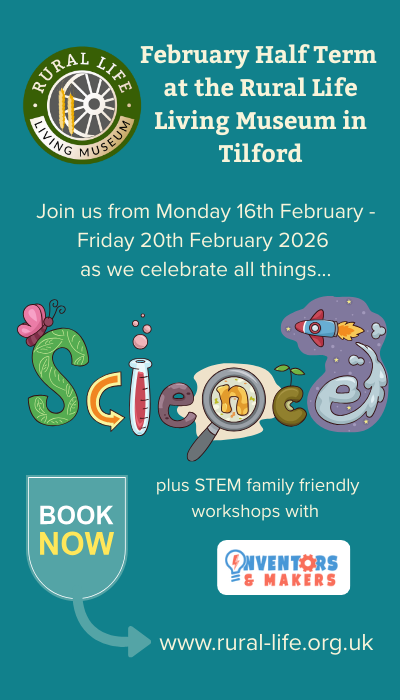

We hear about STEM – where sparks fly and imaginations fire Halliford school… Each year at Halliford School a dedicated enrichment week is held, including a full Robotics Day during which students learn hands-on skills such as soldering a PCB...